Payroll Bureau Service

Payroll Bureau Service

-

Giving you peace of mind that your payroll is compliant, and your employees are paid on time, every time.

-

Recognised by HMRC and accredited by the CIPP’s Payroll Assurance Scheme.

-

Winner of the CIPP Payroll Service Provider of the Year Award 2023 and the Rewards Payroll & HR Software Product Award 2022.

You’re in good company

Confused about payroll outsourcing and payroll bureau services?

In short, payroll bureau services give you the option to choose how much control you have over your payroll, while outsourcing services take it all off your plate. If you’d like to keep a close eye on your payroll processes, stay right here.

The bottom line is, however you’d like your payroll to be run – outsourced, bureau or simply using payroll software – Moorepay can help.

What you’ll receive with quality payroll bureau services

We can manage everything from data validation, calculations, payroll processing, Bacs, payslip printing and distribution, reporting of your payroll, and much more.

Award-winning Payroll & HR Software and Services

At Moorepay, we take pride in being the best in HR and Payroll Software and Services. We’ve even been recognised by prestigious awards – named as the winners of the CIPP’s Payroll Service Provider of the Year 2023 and The Rewards Payroll & HR Software Product of the Year Award 2022.

Working with us means you’ll have access to top-notch payroll solutions and industry-leading software you can trust.

Expect accuracy and worry-free compliance

-

With a 99.9% accuracy rate, you can trust us to pay your people right, on time, every time – it’s all part and parcel of our payroll bureau offering!

-

Our product development team and legislation experts make ongoing updates to our software, so it’s always up to date with the latest legislation.

-

We continually invest in our people so they’re highly skilled, leaving you to enjoy peace of mind over the accuracy of your payroll.

Feel fully supported by UK-based payroll experts

-

UK-based support

Say goodbye to ticketing systems! Your payroll team of 200+ people is always available over the phone or over email, and at no extra cost. -

Highly qualified

Did we mention our people are certified payroll experts? Qualified by the CIPP and with more than 7,000 years’ combined experience – with our managed payroll offering, you’re in safe hands. -

Tailored advice

Our friendly, industry specialists will support you one-on-one with fast-changing, complex legislation, to make payroll and HR easy.

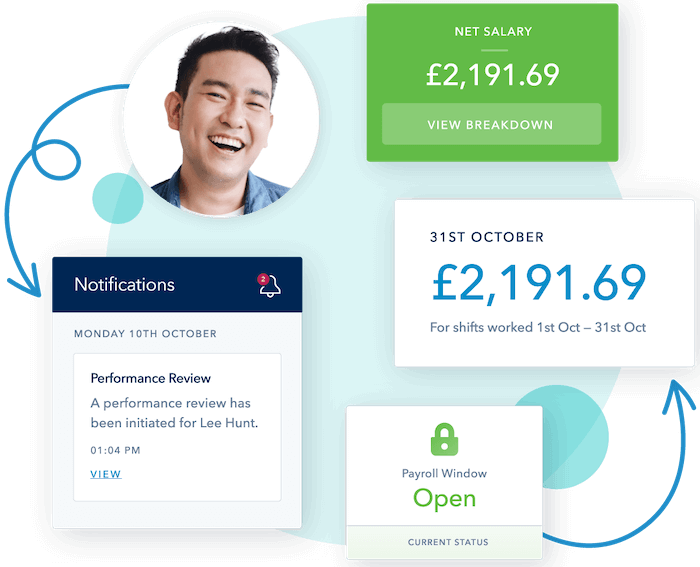

Empower employees with intuitive self-service

-

Catapult the employee experience of payroll and HR into today’s modern world, by giving them access to an easy-to-use Mobile App.

-

Logging in is hassle-free, fast, and secure, thanks to single sign-on, biometric login capability and privacy features.

-

Your employees will easily access their payslips, P60s, and book leave – so you’ll get less queries, and have more time.

easy software

You’ll love our award-winning payroll software

As part of our quality payroll bureau service, you’ll reap the benefits of our award-winning software too.

-

Easy to use

A logical menu structure, intuitive interface and pop-ups that guide you through the software, make it easy to use. -

Easy to access

Online software that integrates with your other systems and can be used anytime, anyplace, make it easy to access. -

Easy to trust

Continuous and robust security monitoring, securely stored data, and technology that’s backed by Microsoft Azure, make it easy to trust.

QUALITY SERVICES

“A fantastic experience” says our customers

Claire Williamson, CFO of Pall Mall Medical, loved our scalable and time-saving software, expert support, and bespoke processes using Moorepay’s Payroll Outsourcing Services.

Badges of honour

Accredited by everyone who’s anyone. We wear our badges with pride.

Switching to us is simple

Our implementation team will make sure your onboarding experience is as streamlined and top-grade as our software is.

Chat to the team

Want to bank on compliance? Need accurate payroll, your way?

Fill in the form to get a quote on outsourcing your payroll.

Payroll Bureau FAQs

-

What is a payroll bureau?

A payroll bureau is an organisation that provides outsourced payroll services to other businesses.

They take care of many payroll processes on behalf of your business, such as providing HMRC with information, processing payments, preparing payroll reports, and processing and sending out payslips.

However, payroll bureaus don’t take care of every single aspect of payroll. Therefore businesses that choose this option usually have their own payroll team in-house to manage other internal payroll processes.

-

Should I use a payroll bureau?

A payroll bureau service is perfect for organisations who want to retain some control over their entire payroll operation. It is ideal if you want to remove some of the workload of payroll admin, but still want to sign off processes in-house.

However, if an organisation wants to outsource their entire function, and therefore remove any payroll responsibilities (and personnel) from their business operations, then fully outsourcing their payroll to a third-party provider is best for them.

-

What’s the process once I have input variable changes?

You’ll send us your payroll data including things like starters and leavers, salary changes and bonuses. During implementation, you’ll be asked to stipulate any variable changes.

Our experts will validate your data. Once we’re happy with the data we’ll input it into our system and make the relevant calculations.

Our experts will check the output, you’ll then receive a review and authorise the payroll. We’ll then produce your employees’ payslips and your payroll reports.

Payslips are then made available to your employees; you’ll get your reports and RTI submissions are made. Employee payment is made on your behalf.

Should you have any, we’ll handle your queries on P60s, payroll calculations, payslips and payments to employees.

-

How does Moorepay process employee Auto-Enrolment?

With pensions arrangements we make the deductions and report to the relevant pension companies on your behalf. See more on our full Auto-Enrolment service.

-

What is the difference between payroll bureau and payroll outsourcing ?

A payroll bureau is like a light version of payroll outsourcing. Choosing a payroll bureau service means many of the day-to-day aspects of payroll process is outsourced to another company. However, some of these responsibilities will remain with your business – and often, you get to choose which parts you’d like to keep, and which you’d like to hand over.

-

How does Moorepay get my payroll data?

When you outsource your payroll to Moorepay, our payroll experts will work with you to gather employee data and create a structure that fits your pay cycle. You will be given a deadline for data submission. This data can be input via our easy-to-use system or via SFT (a secure file transfer of data to Moorepay’s data storage site).

Moorepay will then collect data and prepare your payroll for processing.

-

Do I need to submit anything to HMRC if I use Moorepay’s payroll bureau offering?

You’ll need to send your P11Ds to HMRC. (support on sending / uploading is provided on the HMRC website)

You will also need to calculate and pay the applicable Class 1a NICs associated with the P11D to HMRC. (support on calculating and paying the costs is via HMRC).

-

What happens if one of my employees is over or underpaid?

In the event that an employee of yours is over or underpaid, we’ll work directly with you to discuss the appropriate method to calculate, recall and recover any overpayments or underpayments.

As part of our managed payroll offering, we’ll report overpayments to you immediately once they have been discovered. We’ll ensure the employee record is updated in the Moorepay system to reflect the recovery of overpayment.