Two Major Changes to Itemised Pay Statements

From 6 April 2019 two major changes to the rules on itemised pay statements take effect.

The Employment Rights Act 1996 has been amended meaning that:

- Firstly, the right to an itemised pay statement has been extended to include workers

- Secondly, itemised pay statements must include the numbers of hours worked where the employee’s pay varies by reference to time worked

Both changes are a direct response to the Taylor Review of Modern Working Practices that called for greater clarity over pay for UK employees.

The right to an itemised pay statement has been extended to include workers

Only employees were entitled to a payslip prior to 6 April 2019. Workers weren’t entitled by law to a payslip. However, going forward employees and workers are entitled to an itemised payslip.

A worker includes agency staff, bank staff, casual staff and zero-hours contract staff.

Itemised pay statements must include the numbers of hours worked where the employee’s pay varies as a consequence of the time worked

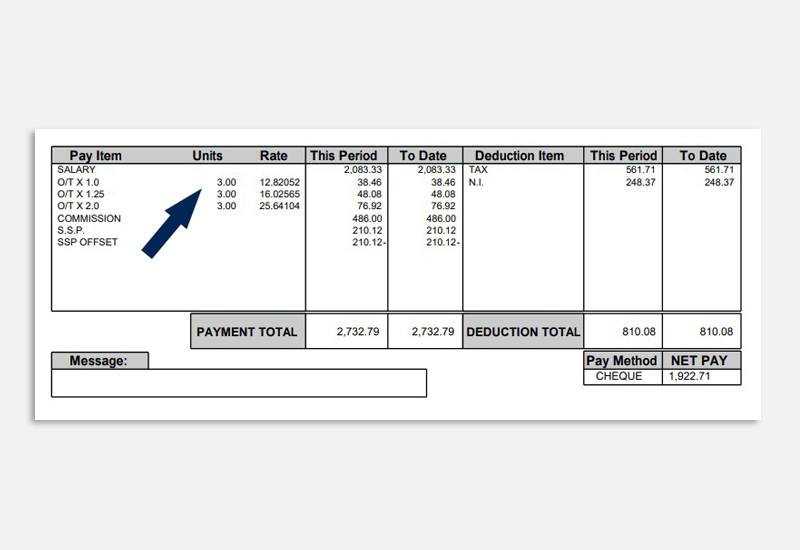

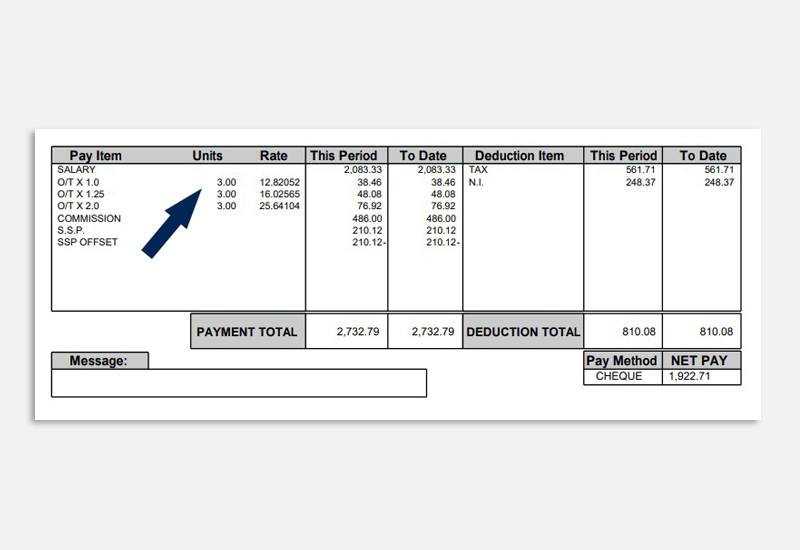

Where a person’s pay fluctuates in accordance to the hours they work, those hours must be shown on the payslip. The hours worked can be displayed as a single aggregate figure, or separate figures for different types of work or different rates of pay.

This only applies to hours worked from 6 April 2019.

What this means for Moorepay Customers

If you are a Moorepay client and currently provide cash only figures in respect of hours worked, please get in touch with your payroll contact at Moorepay who can assist with changing this.

Here’s an example of a payslip showing hours worked:

Moorepay customer who have any questions about the changes to itemised pay statements can call their dedicated payroll contacts.

Moorepay customer who have any questions about the changes to itemised pay statements can call their dedicated payroll contacts.

If you’re considering outsourcing your payroll we have produced a guide to outsourcing payroll.