Ultimate guide

Your ultimate guide to payroll outsourcing

Payroll outsourcing. What does it mean, how does it work, and is it worth it?

We cover absolutely everything you need to know about payroll outsourcing in this super handy guide. From the pros and cons of going outsourced, to finding the perfect provider, it’s all here.

Scroll down to find out more.

Contents

Go straight to the topic you’re interested in by clicking on the text below.

-

Chapter 1

What is payroll outsourcing?

-

Chapter 2

Why should you outsource your payroll?

-

Chapter 3

What are the pros and cons of outsourcing your payroll?

-

Chapter 4

What can you expect from an outsourced payroll service?

-

Chapter 5

When is the best time to outsource your payroll?

-

Chapter 6

Choosing the right provider

-

Chapter 7

How to ensure a smooth onboarding process

-

Chapter 8

In summary

-

Chapter 9

Your guide to payroll outsourcing

Chapter 1

What is payroll outsourcing?

In this chapter you’ll learn

- What key terms you should be familiar with

- How outsourcing works

- What your payroll provider will do for you

Payroll outsourcing simply means to transfer, subcontract, or farm out your payroll processing to another company.

This company will – most likely – be a specialist payroll provider with a team of qualified payroll experts. After all, you don’t want to give the important task of paying your employees to people who aren’t experts in the field.

Payroll outsourcing is for businesses that don’t fancy the daunting responsibility and hairy hassle of processing payroll in-house. ‘In-house’ payroll is where the payroll is processed by an internal employee inside the organisation.

To confuse things, payroll outsourcing is also given some other names:

- Managed payroll is a term you may hear when looking up payroll outsourcing. A managed payroll provider will manage your payroll for you.

- Payroll bureau is also something you might hear. This is a name occasionally used for the payroll provider who you outsource to.

Do companies outsource their payroll?

Yes, yes they do. In fact, according to online sources, 61% of UK businesses outsource their payroll provision to an external payroll company*. Why is that? We’ll get to that in chapter two.

So, how does payroll outsourcing actually work?

Payroll outsourcing done right, results in smooth internal running, satisfied staff and a positive culture.

Let’s see the process in more detail.

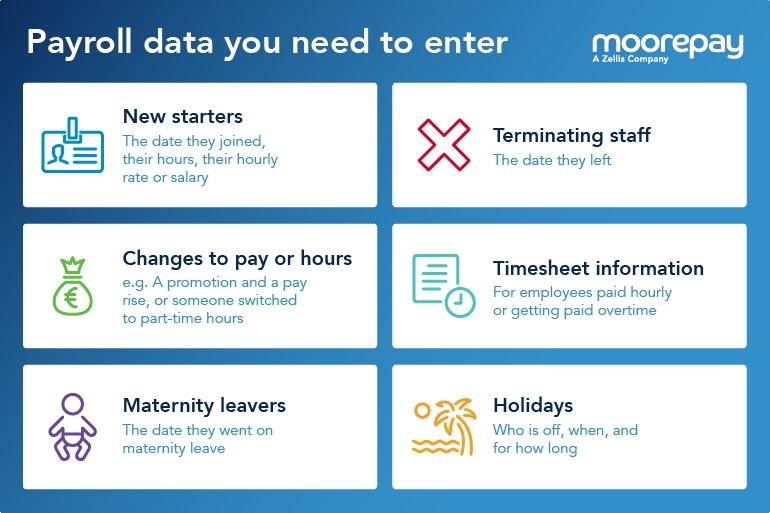

1. Some data input needs to happen at your end

OK, so first up, someone inside your company will need to have some involvement with your payroll. They don’t need to be a payroll expert, but they do need a keen eye for detail because they’ll be responsible for the data entry at your end.

All of this is straightforward data entry. Of course, you need to entrust it to someone in your company who is comfortable with it. You don’t want them accidentally entering extra zeros here and there when updating salary records! But it’s nothing overly complicated and it certainly doesn’t require an in-house payroll expert.

A quick note on data input…

OK, so the next obvious question is: how do you get that data (listed above) across to the payroll provider? Presumably in the olden days it was done using paper and the postal service – what a GDPR nightmare!

These days, some providers may accept spreadsheets, great big long lists and tables of data that need to be uploaded at their end. Of course, that service will cost you more because it’s more work for them.

But whether you do it or they do it, your data must be entered into your provider’s payroll software.

Payroll software is the tool used to organise and manipulate the payroll information you provide. So – unless you’re set on using excel (which we wouldn’t recommend…) providers will supply you with their payroll software. All you’ve got to do is enter your payroll information directly into it.

2. Everything else happens at the payroll provider’s end

Once you’ve input all your payroll data, your payroll provider will take care of everything else! I.e. running the payroll and paying your people.

With payroll outsourcing, you can leave all the heavy lifting to the provider’s payroll experts. They are responsible for things like:

- Making sure payroll processes and pay comply with the latest legislation

- Calculation of payments including statutory payments like sick pay and maternity pay

- Processing your payroll form start to finish and to your specified timetable

- Payments of wages and salary payments via BACs or Faster Payments (depending on what you choose)

- Creating and sharing employee payslips, P45s and P11Ds

- Producing, reconciling and submitting documents required by HMRC

- All Year End processing including employee P60s

How much does it cost?

Of course, pricing will vary from provider to provider. If you’re considering payroll outsourcing as an option for your business and want to know more about the cost, try our blog on how much it costs to outsource payroll.

The beauty of payroll outsourcing is you can leave all the heavy lifting to your provider.

Depending on the complexity of your payroll, there might be a whole heap of other tasks that your provider will take care of for you. And that’s the beauty of payroll outsourcing! For you, it’s a simple case of data-entry each month, no worrying about fast-changing legislation or complicated calculations – you can leave that to the experts.

Chapter 2

Why should you outsource your payroll?

In this chapter you’ll learn

- The five reasons why companies outsource their payroll

- How outsourcing can support other areas of your business

- The facts behind payroll outsourcing

As a payroll provider we may be biased, but outsourcing your payroll has loads of benefits, and we think these vastly outweigh the negatives.

In fact, many myths people hear about outsourcing, like that it’s more expensive than keeping your payroll in-house, are actually false. But don’t take our word for it: read why do companies hire third-party payroll here.

Reason 1: keep compliant with changing legislation

Outsourcing lets you and your employees off the hook when it comes to keeping on top of constantly changing legislation.

There are at least 174 pieces of legislation affecting payroll in the UK at the moment. But it might as well be much, much more. Because as switched on as you are, you probably don’t have a photographic memory. And therefore, it’s difficult to keep track of constantly changing rules.

I’m sure we don’t need to tell you the financial, reputational and legal impact of getting payroll wrong can be pretty unpleasant. Remember the companies named and shamed in 2018 for failing to pay National Minimum Wage? Wagamama, TGI Fridays and Marriott Hotels were amongst the 239 employers found to have underpaid 22,400 UK workers by a total of £1.44m.

239 employers failed to pay National Minimum Wage to 22,400 UK workers by a total of £1.44m in 2018.

This is one of the main reasons why companies outsource their payroll: to access software that automates complex payroll calculations and keep compliant with changing legislation.

With a good provider you not only have help from talented payroll experts, you should also have top-notch software that updates regularly to ensure every pay run is compliant. Say goodbye to scrolling through the HMRC website, and relax!

Read this to find out if an outsourced payroll provider will keep you compliant, and this article if you want to learn four ways to get visibility on compliance from your new provider, should you choose to outsource.

Reason 2: save time and money

Payroll outsourcing might seem like yet another expense that you don’t have room for in your budget right now. But have we got news for you. In reality, the true cost of internal processing is often much higher than outsourcing when you factor in the cost of time. In fact, 32% of SMEs outsourced their payroll because it’s cheaper than keeping it in-house, according to YouGov.

-

32 32% of SMEs outsourced their payroll because it’s cheaper than keeping it in house.

Source: YouGov Research

In addition, outsourcing means you can spend your time more wisely to grow your business. Because although processing payroll is very important, putting that valuable time into other tasks that contribute towards business improvement is going to make a much bigger impact.

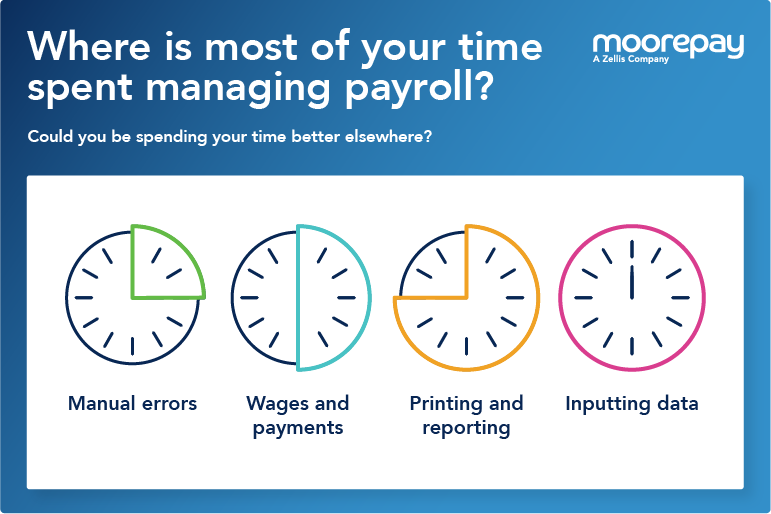

If you’re still not sure, ask yourself how much you spend on the following:

- Getting things wrong such as re-running payrolls, and correcting admin mistakes in addition to the risk of tribunals and government fines. (Don’t worry, everyone’s been there. But you don’t have to be anymore!)

- Distributing wages and payments to employees and 3rd party agencies.

- Printing, reporting and sending files to various government agencies such as the HMRC and Student Loans.

- Inputting your data (keying, re-keying from other platforms such as Sickness and Time & Attendance) – remember, with new modern solutions, connectors allow you to seamlessly transfer data from one platform to another.

Here’s more on how to measure the true value of payroll outsourcing.

Reason 3: support business growth

Are you a growing business, with, say 40, 50 or a few hundred employees? The likelihood is the current off-the-shelf payroll software package you’re using isn’t fit for purpose anymore.

You see, once your company’s employee numbers tip over certain thresholds (the 30-50 mark being one of them), off-the-shelf payroll software:

- Has more hidden costs

- Is increasingly risky

- Takes up a lot of time

- Negatively impacts recruitment and retention

Moving to a managed service made for your business size may help you avoid these issues. It will also provide the joy of a bespoke service that’s more than capable of taking on all of the payroll processing, distribution and reporting for you – leaving you to focus on developing your business.

Yes, it can be scary to leave the – albeit somewhat cramped – comfort of your old provider. But trust us when we say your new home will be much more suitable.

Reason 4: removing a single point of failure

Does this sound familiar?

You have one person who runs your payroll: Julie. Julie works a few days a week and can’t book holidays off during the peak pay season because no-one else can do her job as well as she can. (Once the MD did it when she was ill but forgot to take off the tax – a mistake he’ll never live down!) You wanted to hire someone to support Julie but you’ve not got the workload to justify a whole other job. As a result, you have no idea what you’d do if Julie was off sick or left the company!

Astonishingly, according to the CIPP’s Future of Payroll Report, over half of participants reported they don’t have a succession plan within the payroll department – meaning the likelihood is that for most businesses, the payroll department consists of one person, like Julie. But what happens when that person is absent?

By outsourcing payroll, you don’t need to worry about these things, as you have a whole team of Julies to support you, all of whom are up-to-date with legislation and always available to provide support. They can check and double-check your pay run, and you can remove any single point of failure that might negatively affect the employee experience. All of this, simply by outsourcing!

-

59 Over half of participants reported they don’t have a succession plan within the payroll department.

Source: CIPP’s Future of Payroll Report, 2020

Reason 5: improve the employee experience

Payroll processes have a massive impact on how satisfied an employee is in the workplace.

According to a study by Moorepay, one in five employees have quit their job over a poor payroll experience. That’s 20% of the workforce. Imagine if 20% of your staff your company left right now. That would be pretty difficult to recover from.

However, when looking into it, it’s no wonder so many people have quit their jobs over payroll when you learn that ‘overpayment or additional hours not paid’ was the most common type of enquiry into their payroll department for 48% respondents. Furthermore, Moorepay’s research revealed 60% of people have spotted mistakes on their payslips and 39% have been paid late.

How payroll affects employee experience

-

60

of employees have spotted mistakes on their payslips

-

39

of employees surveyed have been paid late

-

20

of employees have quit their job over a poor payroll experience

There’s no doubt that getting people’s pay wrong or doing it late is a sure-fire way to make your employees feel undervalued and demotivated. But if you’re running your payroll internally, it is, unfortunately, an easy mistake to make when payroll processes aren’t automated. Many manual calculations go into each payroll run, and human error is inevitable.

Which is why many people choose to outsource their payroll, particularly when moving over to a managed service means there are far fewer errors.

A more consistent and reliable payroll experience = a happier workforce + increased retention.

Chapter 3

What are the pros and cons of outsourcing your payroll?

In this chapter you’ll learn

- The known benefits for outsourcing

- Top reasons people outsource

- The pros and cons in a handy table

What are the benefits often cited for outsourcing payroll?

Research from YouGov shows that nearly half of SME respondents (49%) said the primary reason to outsource their payroll was to deliver better results. Other popular reasons cited by SMEs include ‘it’s more efficient’ (44%), ‘a lack of qualified/relevant staff in house’ (36%) and ‘it’s cheaper’ (32%).

With payroll legislation constantly changing, many businesses find they deliver better results and increase accuracy and efficiency through outsourcing their payroll.

Top reasons why SMEs favour outsourcing

-

44 because it’s more efficient

-

49 because it delivers better results

Source: YouGov -

36 due to lack of qualified or relevant staff in house

But there are two sides to every story. We’ve listed the pros and cons of outsourcing your payroll below.

The pros and cons of outsourcing your payroll function

| Pros | Cons |

|---|---|

| Reduced costs. You can save costs on personnel – such as salary, pensions, desk costs, and staff turnover – that could be more profitable spent elsewhere. | You won’t necessarily be able to access your software to check in when you want to or add anything that’s missing etc. |

| You will free up time that you can put towards growing your business. | Depending on your provider, there may be a delay in getting in touch with your payroll contact to deal with any queries. |

| Easily stay compliant with tax obligations, PAYE responsibilities and changing legislation that are part and parcel of the service. | If you have a team of payroll professionals at your company, you’ll probably have to let some of them go. Although this is good for profitability, it can be a difficult decision to make. |

| Eliminating a single point of failure i.e. human error that can lead to big issues (see above). | Loss of control, particularly of sensitive and confidential information about your staff. Ensuring your provider is GDPR compliant is key to ensuring you’re covered. |

| Knowledge of legislation in different areas, not just England (e.g. if you’re operating in Ireland or Europe as well as England, different rules apply which can be accounted for). | Sorry, we ran out of cons. |

| Safety nets of a whole business supporting your payroll, rather than just one member of staff: guarding against failed deliveries and mistakes in data entry. | But we like the keep the table looking even. |

| Reduce the need for training in-house payroll staff. | So we’re just going to leave these points in here. |

| Great payroll software should be included in your contract with your supplier – say goodbye to spreadsheets and hello to a more professional experience for your employees. | We hope you understand. |

Learn more about the risks of payroll outsourcing here.

Are you still worried your payroll might be inaccurate, even when outsourced? Read up on how to ensure your outsourced payroll is accurate.

Further reading on payroll outsourcing

Click on the links to learn more

-

What are the risks of payroll outsourcing?

Outsourcing your payroll does come with an element of risk. These are the seven most common risks of moving your payroll to managed.

-

Outsourcing payroll for small businesses

Timely, accurate payroll delivery is arguably one of the most fundamental parts of your business. Payroll has a key role to play in maintaining morale, productivity and trust.

-

How much does it cost to outsource payroll?

If you’re thinking about outsourcing your payroll, you’re probably wondering how much it costs. Here’s a breakdown of what you can expect.

Chapter 4

What can you expect from an outsourced payroll service?

In this chapter you’ll learn

- What payroll processes will be handled by your provider

- What software you can expect

- The level of support you can count on

So you know the pros and cons, the risks, and the reasons to get managed payroll services. But what will it actually look like? What will you actually get for your money?

1. Payroll processing

Your provider will take all the payroll management off your hands. So calculating how much people is due to be paid, including tricky statutory payments, sickness, overtime etc., and sending the relevant information and documents to HMRC is all sorted for you.

You can expect them to deal with:

- Calculating how much you need to pay your employees, including part payments, sickness, maternity, paternity, etc. This includes payments via BACS transfer or Faster Payments for salaries and third parties.

- Then, of course, paying these employees on time every month.

- Making, checking and submitting documents required by HMRC.

- Doing any additional supplementary runs (late starters/bonuses) or early runs (leavers) if required at an agreed rate.

- Year End processing with P60s if needed.

- Backing up data.

- Publishing / printing and sending payslips, P45s and P11Ds.

2. Payroll software

Having a provider also gives you access to their payroll software. A designated person on your team will probably only have to use the payroll software to enter basic information if anything changes, but it might give you additional insight into your HR data and be much easier to use than Excel spreadsheets (for a good quality provider anyway). In some software, employees will be able to login to see their payslips and documents too, which is very handy.

Plus, software has the capacity to grow when you do!

3. Expert support

A good payroll provider will offer support and advice for their customers. Often, you’ll have your own expert to speak to directly over any questions you might have over payroll, or to support you entering new data, such as adding a new starter to the payroll.

Read the first section of this guide to learn more about the division of responsibilities between you and the provider. Hint: the provider will do most of the work!

Want to know what you can expect from Moorepay?

Speak to a member of our team to learn more about our Payroll Outsourcing service.

Chapter 5

When is the best time to outsource your payroll?

In this chapter you’ll learn

- When is the best time to outsource your payroll?

- Other factors that may affect implementation

You know your business better than most. Thus, know there’s a right time for your organisation to outsource its payroll function.

After all, every business is different, and yours is no exception.

There are certain tell-tale signs that managing your payroll in-house isn’t working for you, and if you’re reading this guide you’re probably knee-deep in them. If your payroll team is struggling, your business is growing, or you’re suffering from mistakes in the payroll process, it might be time for a change.

The best time of year to outsource your payroll

The long and short of it is, any time of year is a good time to outsource your payroll – it really depends on your business’ needs.

However, most people look to outsource their payroll about three months before the financial year starts. So if your financial year ends on the 31st March, you should start the process of changing your payroll in December of the previous year.

This just helps with closing employee records and reports, and aligning contracts with the start of the financial year, which will be a bit easier to manage in the long run.

Many businesses choose to move payroll provider at the end of the financial or tax year, but you can switch any time of year.

Factors that affect the onboarding process

- Your existing contracts: You might want to time your switch to when your current contracts with your existing payroll software provider is due to renew, if you have one.

- Your research process: How thorough do you want to be when researching your new payroll provider? Give yourself enough time to plan and prep properly.

- Peaks and troughs: If any exciting things are happening in your business that require a lot of everyone’s time, energy and/or office beer supply – the chances are a payroll provider won’t be a big priority for everyone. If that’s the case, it might not be the right time to be having these conversations and you might want to hang on until a quieter period.

- Procurement process: How long does it usually take to get sign off process? How many people will you have to go through? You might want to add a bit of time to cater for this delay.

- Implementation process: The time it takes for your chosen provider to set up your payroll might affect when you want to get started. At Moorepay it can take as little as four weeks to get set up and start implementing, but with other providers it could be a lot longer.

- Parallel pay runs: Parallel runs are usually most helpful when a company has various pay cycles: for example, weekly, fortnightly and monthly payroll or if it has varying rates such as maternity pay, SPP, and overtime. The more complicated, or the bigger your organisation, the more parallel runs you will want to do.

- Remember the golden rule: Don’t switch over mid pay-run!

Chapter 6

Choosing the right provider

In this chapter you’ll learn

- How to identify what you want, what you really really want

- Six simple steps to choose a provider

Narrowing down your options

When it comes to choosing your payroll provider, there are so many options to choose from. A quick Google search of ‘payroll provider UK’ can bring up an overwhelming number of worthy candidates.

So, to help you decide, here are some key questions to ask yourself that can help you narrow down the selection:

- What is and isn’t working about your current payroll processes? Will the new provider help resolve any issues you have currently?

- Does this provider have track record working in your industry?

- What is the typical size of business that this provider services? Does yours fit comfortably in this category, with room for growth? For example, Moorepay service companies sized 30 – 1,000 employees, whereas if you’re over 1,000 a provider like Zellis would suit you better.

- If experience and expertise is important to you, how many years has the provider had in the industry?

- Does the software automatically update with changing rules and legislation? If it does, do you want these updates to be free?

- What level of security does their software offer? You’re going to want certification or assurance your sensitive data is being handled correctly. Accreditations such as ISO9001, ISO27001 and PAS Proven Expertise show that their security is reliable.

- Is the software cloud-based i.e. can you use it anywhere? With home working being the new normal, technology that can cope with remote working is essential.

- Is it easy to use? This may sound like a given, but believe us when we say we’ve heard some horror stories when it comes to outdated software. A short demo of the software should help you figure this out.

- What do the reports look like? And what insights will you need from the analytics available?

- What other software you use will you need to integrate your payroll processes with? Make sure the payroll software you’re using is compatible.

Choosing a new provider in six simple steps

Now you’ve got an idea of what you want, you can put this into action! This fool-proof process will help you easily identify which provider is ‘The One’.

- Do your research. You can start with Googling, asking around for recommendations and reading through brochures. Nothing like a bit of bedtime reading!

- Shortlist three providers. Using the questions above, you can narrow down your search into the providers that look the most suitable for your business’ needs.

- Arrange a demo. Initiate a call with your top three candidates for a software demo. They’ll probably ask a lot of questions to help personalise their software to your requirements. In turn, you can ask them about the onboarding process to understand how each provider can ensure a smooth switch.

- Review their reputation. Ask if you can speak to any of their customers for a reference and check out online review platforms like Trustpilot to learn more. Another indication of a good reputation is the CIPP’s Payroll Assurance Scheme accreditation (PAS) – is this something they have?

- Get to grips with their security. As discussed, you’ll want to look out for relevant accreditations and certifications including the ISO accreditation and Cyber Essentials certified certification.

- Get the right people involved. Think of who in your organisation might use the system, and ask for their feedback on software demos or features to help inform your final decision.

Free tip: use a scorecard! This is helpful to make side-by-side comparisons of your shortlist as you go.

Chapter 7

How to ensure a smooth onboarding process

In this chapter you’ll learn

- A step-by-step process of onboarding

- Our top tips

Outsourcing your payroll function should be a smooth process. Here’s what we recommend to make sure this is the case.

1. Communicate to your employees

Switching to a new system will affect different employees to varying degrees. Day-to-day users of the system will need regular communication and support.

To gain their buy-in, explain why you are switching and the benefits it will bring as well as who to contact if they have any questions.

2. Resourcing

Although your provider will be doing the bulk of the work, make sure that you’ve put some time aside for the move as well. The majority of this will be collecting data on your employees to pass over to your new provider, which they will help you with.

3. Timing

Getting the timing right can help a lot e.g. avoiding the busy end-of-the-month pay period will help everyone involved. You might also want to avoid any busy periods that affect your business specifically. Many businesses choose to move to a new provider at the end of their financial year or the tax year, to keep their admin neat and tidy, but you can really change to a new payroll provider any time of year.

4. Parallel pay run

For best practice, your payroll provider may also do one or more parallel payroll runs. This means doing a ‘dummy’ run alongside yours to check your calculations are coming up the same to make sure no errors occur on your first go-live pay run. They might need to do this several times if you have a complex or large employee base.

Read our switching guide for more information on changing to a new payroll provider.

Chapter 8

In summary

In this chapter you’ll learn

- If outsourcing is right for you

- Further reading

To wrap things up, outsourcing your payroll function is not for everyone. But if you’re looking to take the next step in growing your business whilst saving resources, it could be a strategic move for your company.

We hope that you’ve learnt a lot from this ultimate guide to outsourcing your payroll. If you’d like any more information on this topic, search in our Knowledge Centre, or contact 0345 184 4615.

Chapter 9

Your guide to payroll outsourcing

In this chapter you’ll learn

- How to download this take-away guide

PDF guide

Your guide to payroll outsourcing

Download a PDF version of this guide and take it with you.

In this guide, you will learn:

-

Why outsource your payroll

-

Choosing a provider

-

Managing the transition

-

What to expect from a managed service

Contents

Go straight to the topic you’re interested in by clicking on the text below.

-

Chapter 1

What is payroll outsourcing?

-

Chapter 2

Why should you outsource your payroll?

-

Chapter 3

What are the pros and cons of outsourcing your payroll?

-

Chapter 4

What can you expect from an outsourced payroll service?

-

Chapter 5

When is the best time to outsource your payroll?

-

Chapter 6

Choosing the right provider

-

Chapter 7

How to ensure a smooth onboarding process

-

Chapter 8

In summary

-

Chapter 9

Your guide to payroll outsourcing

About the author

Cybill Watkins

Cybill is Group Product Legislation Manager at Zellis Group, which includes Moorepay, Zellis and Benefex. She’s a self-described payroll geek with an obsession for payroll and HR laws, which she uses to advise and educate on everything legislation both within the team and externally. She’s also a advocate of neurodiversity in the payroll industry.