Online Payroll Software

-

Recognised by HMRC and accredited by the CIPP’s Payroll Assurance Scheme.

-

Winner of The Rewards Payroll & HR Software Product of the Year Award 2022.

-

Our easy, cloud-based Payroll Software is safe and secure on the latest Microsoft Azure technology.

-

It’s packed with automation to save you time, guarantee accuracy and ensure worry-free compliance.

You’re in good company

What does our cloud-based Payroll Software actually do?

Our award-winning, Next Generation Payroll & HR Software has plenty of bells and whistles to make your life easy.

-

Automated calculations

Software that does the hard work for you. No need to manipulate your data offline: our software incorporates the latest SSP, OSP, holiday accruals, over and under payments to leavers, and Auto-Enrolment legislation to calculations, and runs them for you.

-

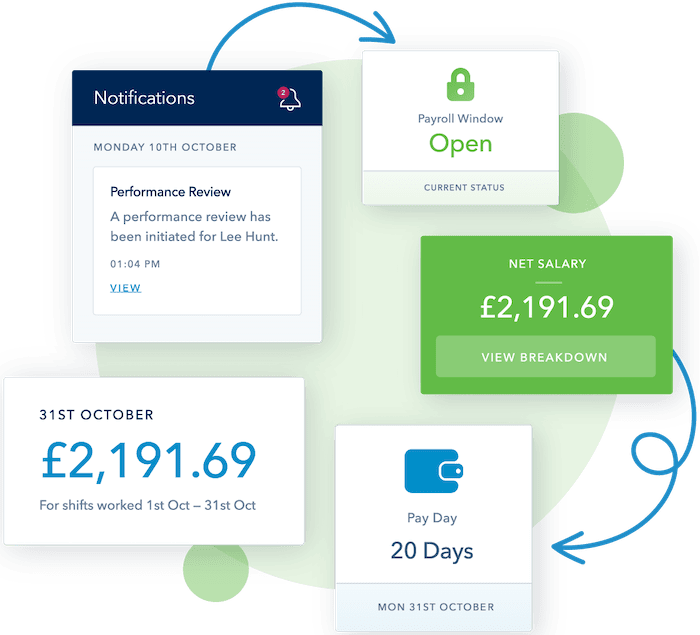

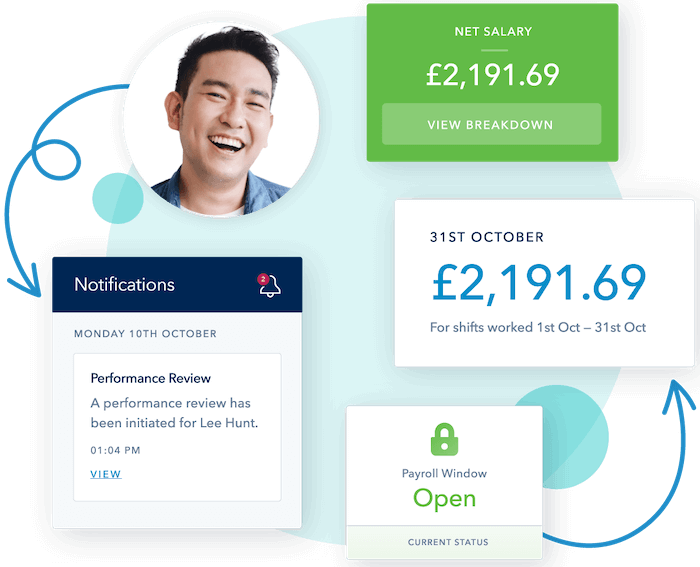

Payroll dashboard

- See your payroll tasks, countdown to payday and payroll lockdown all in one place.

- Our dashboard is easy to navigate, that means no more endless searching for screens, and flipping between systems – managing payroll is much easier!

- Need to make changes? It’s easy to restore payroll to the point prior to cleardown.

- Jump to the next section to learn more about our easy payroll dashboard.

-

Open APIs

- Our Payroll and HR Software are one and the same. That means one source of truth and one point of data entry.

- Our open API infrastructure means you can hook your existing software up to your payroll and HR system, saving you time and ensuring data accuracy.

-

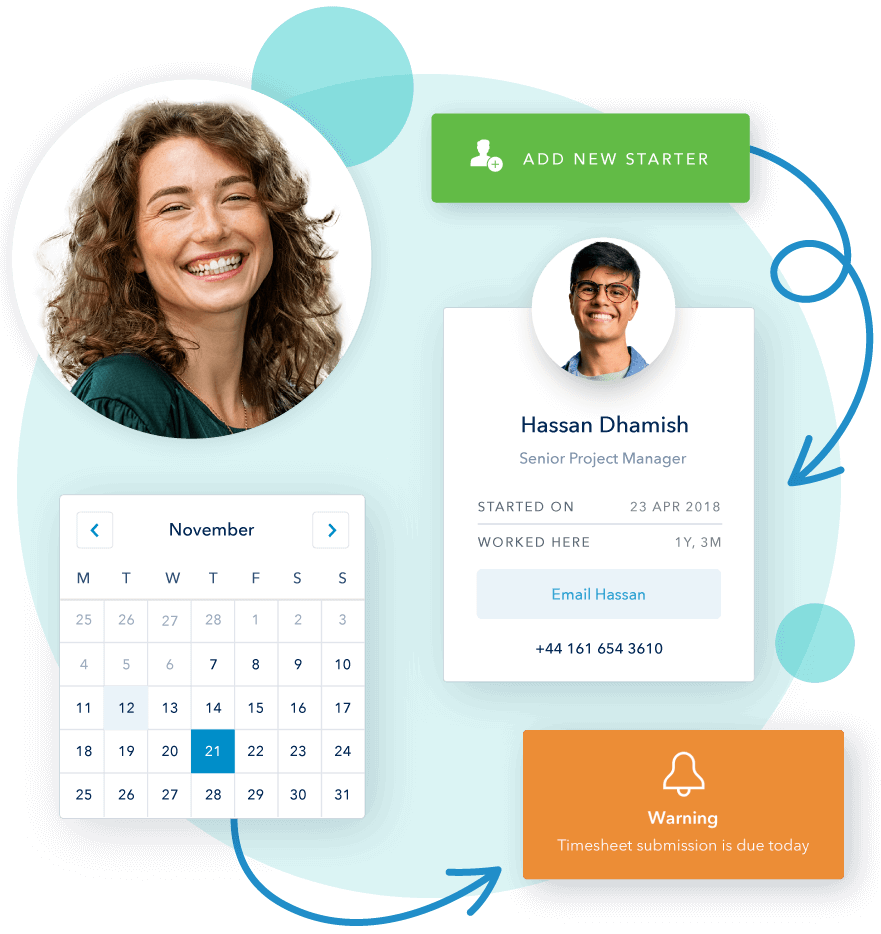

New starter wizard

Get helpful prompts when inputting your new starter data. Save time by only inputting your people data once, before it’s reflected in real-time across other areas of the system.

-

Rapid employee searching

- See all your people data in one place. Quickly find the people you’re looking for and make changes where necessary with an intuitive search function.

- No more wasting time cross referencing across systems and documents, the filter function makes it even easier to search by department, cost centre or other details.

-

Timesheets & expenses

- Let employees input their own timesheet and expenses data through cloud-based Employee Self-Service available in app and via desktop.

- Bespoke hierarchy functions ensure approval is directed to the right person in your business.

- As an admin you’ll be able to bulk upload timesheets. No more manual and time-consuming timesheet uploading and laborious hours of admin.

- Get instant notifications on submissions so your managers can make speedy approvals.

-

Reporting & analytics

- Our best-in-class Analytics module lets you find your payroll data quickly.

- Export ‘out-of-the-box’ compensation dashboards or customise your metrics and drill-through into spend and salary by department and location.

- Quickly find gender pay gap reports ready for submission and review.

- Our Report Builder tool allows you to go granular with your payroll data, saving metrics to revisit as you like.

- Should you have a bespoke reporting requirement our tech team are on-hand to deliver it.

-

Auto-enrolment ready

- Workplace pensions made easy! Calculate employer and employee pension contributions at the push of a button, upload the pension contributions to the pension provider and initiate payment with the pension provider.

- Easily manage your opt-ins and outs in software and see it reflected in employee deductions.

- Learn more about our auto-enrolment pension solution.

-

Helpful reminders & support

Built in features and reminders make payroll processing even easier, making sure you never miss a deadline. Guided support features throughout the software make it super user-friendly – both you and your employees have support on tap.

Worry-free compliance, every time

-

Maintained by experts

-

Our dedicated legislation team fuel our payroll software. We test our payroll calculations properly and ensure they reflect legislation way ahead of time. Never question your payroll processes, and bank on worry-free compliance.

-

-

Proper visibility

-

Spot issues before they happen. View discrepancies, see net to gross and variances month on month so you never let a mistake pass through payroll.

-

-

Accurate employee payments

-

Never feel payday panic again. Know your processes are shipshape so you can nail payslip accuracy. With complete payslip visibility employees can access their pay data, where they want, when they want.

-

“The main benefit of Moorepay is the payroll system, in that it’s scalable which allows us to ensure as we grow as an organisation we can continue to pay our employees. The system from an admin and management perspective is very user friendly and the team’s always on hand to answer questions in the rollout.“

Claire Williamson, Chief Finance Officer at Pall Mall Medical

easy to use

Expect plenty of automation and flexible integration

-

Automated calculations

-

Our cloud-based payroll software is packed with automated calculations, so the payroll heavy lifting is done for you – saving you time and money!

-

-

Accuracy and compliance

-

From OSP, SSP, AE and holiday accruals, all rates are auto applied – with accuracy and compliance as standard.

-

-

Flexible integration

-

Our flexible payroll software easily integrates with your existing systems, be that HR, time and attendance, benefits (the list goes on) – so no more double data entry!

-

easy to access

Bye bye same-old old queries. Hello Mobile App!

-

Boost the employee experience of payroll and HR by giving them access to an easy-to-use Mobile App.

-

Logging in is hassle-free, fast and secure, thanks to single sign-on, biometric login capability and privacy features.

-

Your employees will easily access their payslips, P60s, and book leave – so you’ll get less queries, and have more time.

easy to trust

Technology you can rely on

-

Microsoft Azure

-

Our secure payroll software is built on the latest technology and backed by Microsoft Azure.

-

-

Cloud-based

-

Anywhere access means greater flexibility for you and your employees.

-

-

Secure

-

We undertake ongoing vulnerability scans, regular pen testing, and continuous monitoring through the market leader, BITSight.

-

P11D Service

With our P11D Service, we handle all the complexities, so you don’t have to deal with stressful submissions to the HMRC, nor worry about complying with new rules. Let us fuss over painful admin, ensuring total compliance and timely documentation. A perfect pairing with our Payroll Outsourcing or Payroll Software solutions.

Never question accuracy again

Leave the payroll calculations and compliance checks to us. Book a demo to see how our Payroll Software can do the heavy-lifting.

It’s easy to use, but our UK-based team is here for you

-

Hands-on technical help

-

Say goodbye to raising tickets and waiting around. Whenever you need technical support, our team of friendly experts are available over the phone or over email, and at no extra cost.

-

-

Real support from real people

-

We’ll also make sure you get the most from your cloud-based payroll software with additional support from real people, whenever you need it.

-

-

Experts keeping you compliant

-

Our industry specialists keep up with fast-changing, complex legislation, to keep our payroll software up to date and make payroll & HR easy.

-

Switching to us is simple

Our implementation team will make sure your onboarding experience is as streamlined and top-grade as our software is.

Report on your payroll – fast!

-

Compliant payroll every time

-

Quickly identify discrepancies in pay, amend and confidently submit to HMRC. Have full oversight over ‘everything’ payroll and keep on the right side of legislation.

-

-

Reduce report admin

-

Quit triple-checking the validity of your data. Trust consolidated data that’s pulled from a single source of truth, and spot payroll issues all from one system.

-

-

Accurate data that’s easy to understand

-

Customise and run reports on everything that matters to you so you can quickly action insights off the back of it.

-

Hot new feature

Leavers access

-

Stop manually sending pay documents to past employees, reduce admin and let them self-serve.

-

Keep company information safe from those who are no longer in your business.

-

Bespoke your system to suit you, set how long past employees can access their documents.

Payroll & HR complete

All-in-one software

Payroll & HR Software are better together. Enjoy a truly complete solution with our all-in-one platform. Learn more here.

What do our customers think?

Don’t just take our word for it! Hear it directly from our payroll software customers.

-

Pall Mall Medical

Watch the video testimonial to see what Pall Mall Medical think of Moorepay’s Managed Payroll Premium bundle.

-

Valor Hospitality Europe

Moorepay’s Payroll Software offers Valor Europe reliable software with rich functionality and automatic payroll compliance.

-

Landal GreenParks UK

Managed Payroll, Auto Enrolment and People Analytics are all sorted for Landal GreenParks. So they can focus on their customers.

Badges of honour

Accredited by everyone who’s anyone. We wear our badges with pride.

Payroll software FAQs

We answer the most frequently asked questions about our payroll software.

If you want to process your payroll in-house, Moorepay’s payroll software is designed to make this easy. Save time with automated calculations and workflows and take advantage of rich functionality. Plus, you can contact our payroll team if you need help with the software. If you don’t want to do any payroll processing within your team and you want to outsource it, choose our managed service. You’ll still use our intuitive payroll software to enter your data – but our team of experts will take care of the payroll processing and ensure you’re compliant with the latest payroll legislation.

Moorepay provide leading-class payroll & HR software, with true integration. That means if employee details are changed in one system then it’s reflected in the other system in real-time. For example, if employee banking details are changes in Moorepay’s HR Software then this change is reflected in the Payroll Software.

If you already have other business tools currently in use then data connections can be made through API integration. Our open API infrastructure allows data to flow seamlessly between Moorepay and third-party applications.

We can also enable flat file data exchange and powerful import and export capabilities through our Mapper tool that allow integration.ayroll & HR software has an open API (Application Programming Interface), this means it will happily talk to other systems, whilst maintaining strict data security.

We’ve maintained the Chartered Institute of Payroll Professional’s PAS (Payroll Assurance Scheme) accreditation since 2012. This means regularly passing a rigorous audit that was developed in partnership with HMRC. We’re also ISO accredited for both Quality Management and Information Security Management, and have the government backed Cyber Essentials certification. Plus, we’re proudly HMRC approved and accredited by the Bacs Approved Bureau Scheme.

We can move you over to Moorepay in as little as four weeks! We have a huge implementation team who manage the process and make it easy. In fact, this team are always getting 5-star reviews on Trustpilot from new customers saying how fabulous they are – check it out!

Every employee will have access to a cloud-based self-service platform that allows them to view and edit their personal details, view their pay history and download and view their payslips.

If the expenses and timesheets module is a part of your software then employees will also be able to submit expense and timesheets for approval. Managers will be able to view these details, approve, reject or request more information on requests.

Users on our Next Generation Payroll & HR Software will have access to the Moorepay Mobile App. This allows employees to manage their pay and details on the go. You can find out more about our

Mobile App and its functionality here.

Our customers love us because – unlike some of our competitors – we give them direct access to fully qualified, UK-based payroll support. That means a dedicated account manager you can contact when you need help. There’s no ticketing system, no waiting days for a response; just pick up the phone and talk to us.tact when you need help. There’s no ticketing system, no waiting days for a response; just pick up the phone and talk to us.

Our products are designed for a wide range of business sizes. The majority of our customers have around 30 to 1000 employees. We do have customers who are outside of that bracket, however, it depends on what the requirements are, so give us a call and our team will advise you.

Not only are Moorepay the market leader for payroll & HR software, we’re experts in protecting your sensitive data. We are ISO 27001 Accredited, which means we are regularly audited and maintain high-levels of security across our software.

Customer payroll data is stored in a purpose-built UK-based data centre, owned and operated by IBM. All data sent to and from our services are protected through a 256Bit SSL Certificate using the HTTPS protocol.

Our security team run regular Pen tests and vulnerability scans that give a snapshot of security. In addition to our security monitoring system, BitSight, which is continually monitoring and checking security levels and vulnerability.

Definitely, we have an entire team of auto enrolment experts! Simply choose a pension provider, send us your employee data, register with the Pensions Regulator – and we take care of the rest. Visit our Auto-Enrolment page to learn more.

take it away